Age Omne Bonum

(translation – "Do All Good Things")

We strive to help our clients "do all good things" by engaging with them in the financial planning process, creating deep and meaningful relationships that last for generations. Your Financial Security Is Our Business.

Schedule a Meeting

MATTHEW ALLGOOD, MBA, CRPC®, CFP®, CKA®

Principal & CERTIFIED FINANCIAL PLANNER™

Matthew grew up the 5th child of a small-town Southern preacher. Growing up in those circumstances instilled in him the values he brings to his work today as a certified financial advisor. Combining that with a solid education and credentials from top universities like Vanderbilt University, where he studied Public Policy; Northwestern U’s Kellogg Graduate School of Management, where he earned an MBA in Marketing & Finance; and DePaul University, where he earned a Certificate in Financial Planning, Matthew has the depth of knowledge and understanding to offer top-notch financial planning services to his clients. His 4 years as a banker in commercial lending pre-MBA, and 8 years of Corporate Finance post-MBA work also give him non-advisory, “real-world” experience. This experience helps him identify with clients and the challenges they face, making him a valued certified financial planner for wealth management retirement planning.

Who We Are

Have a look at our specialized services and see if they suit what you're looking for.

Our Services

There are many financial products in the market, let us help choose the products best suited to your situation.

Rely On Allgood Financial For Retirement & Investment Management Services

At Allgood Financial, we understand that "all good things" don't just happen. Instead, they emerge from meticulous planning, execution, and a commitment to securing present needs and future aspirations.

This is one of the reasons we offer investment management services tailored to our clients' needs.

Our mission is to aid you in constructing a robust financial framework that not only withstands the trials of time but also flourishes, generating wealth for you and your loved ones.

Our Vision

Our vision at Allgood Financial is rooted in the belief that financial security is not an end but a means to empower you to pursue your dreams unhindered by monetary constraints.

By offering comprehensive retirement investment services, we aspire to be the architects of your financial fortitude, guiding you toward a future where your aspirations are within reach and your financial well-being is pursued with the utmost efficiency.

Our Process: Building on Foundations, Creating Opportunities

We have developed a comprehensive process around two pivotal financial security pillars: asset preservation and wealth creation. Our approach is twofold: safeguarding your existing assets while fostering their growth through prudent investment strategies.

Asset Preservation

We recognize that life is unpredictable; thus, our foremost priority is to shield you and your loved ones from unforeseen adversities. Whether it be a disability, critical illness, or the unfortunate event of death, our plans are meticulously crafted to provide income replacement and asset protection, ensuring that your financial legacy endures.

Wealth Creation: Nurturing Prosperity, Ensuring Legacy

While safeguarding your assets is imperative, we also strive to maximize their growth potential. Through astute retirement wealth management and tax-efficient strategies, we endeavor to cultivate a robust wealth portfolio that fulfills your current needs and lays the foundation for a prosperous future.

Building Wealth, Protecting Futures

At Allgood Financial, we recognize that each individual's financial journey is unique. Therefore, our process begins with thoroughly assessing your financial landscape, encompassing short-term objectives, such as major purchases, to long-term aspirations like retirement and legacy planning. By understanding your goals and aspirations, we tailor our services to meet your needs, ensuring that every financial decision aligns with your vision for the future.

Partner with a Kingdom Advisor

Matthew is proud to be a Certified Kingdom Advisor® (CKA®), providing financial guidance that aligns with the Christian faith. Together with his clients, he develops financial strategies that honor God, serve families, and advance His Kingdom through wise stewardship of the resources He has entrusted to them.

Our Commitment to You

We collaborate with you to define personalized short- and long-term goals, guiding you in selecting the most appropriate financial products and services tailored to your needs.

Here are some of the ways we seek to help our clients:

- Gap Analysis

Identifying potential roadblocks or gaps in your financial plan, we proactively address any obstacles that may impede your financial trajectory.

- Continuous Monitoring

Your financial journey is dynamic, and so is our commitment to you. We regularly review and adapt your financial plan to accommodate life changes, ensuring that it remains aligned with your evolving needs and aspirations.

Partner With Us For Retirement Asset Management Services!

At Allgood Financial, your financial security is our utmost priority. We offer targeted investment advisory services for our clients.

With our unwavering dedication and comprehensive approach, we aim to secure your present and empower your future.

Let us embark on a journey toward financial prosperity and increased confidence together.

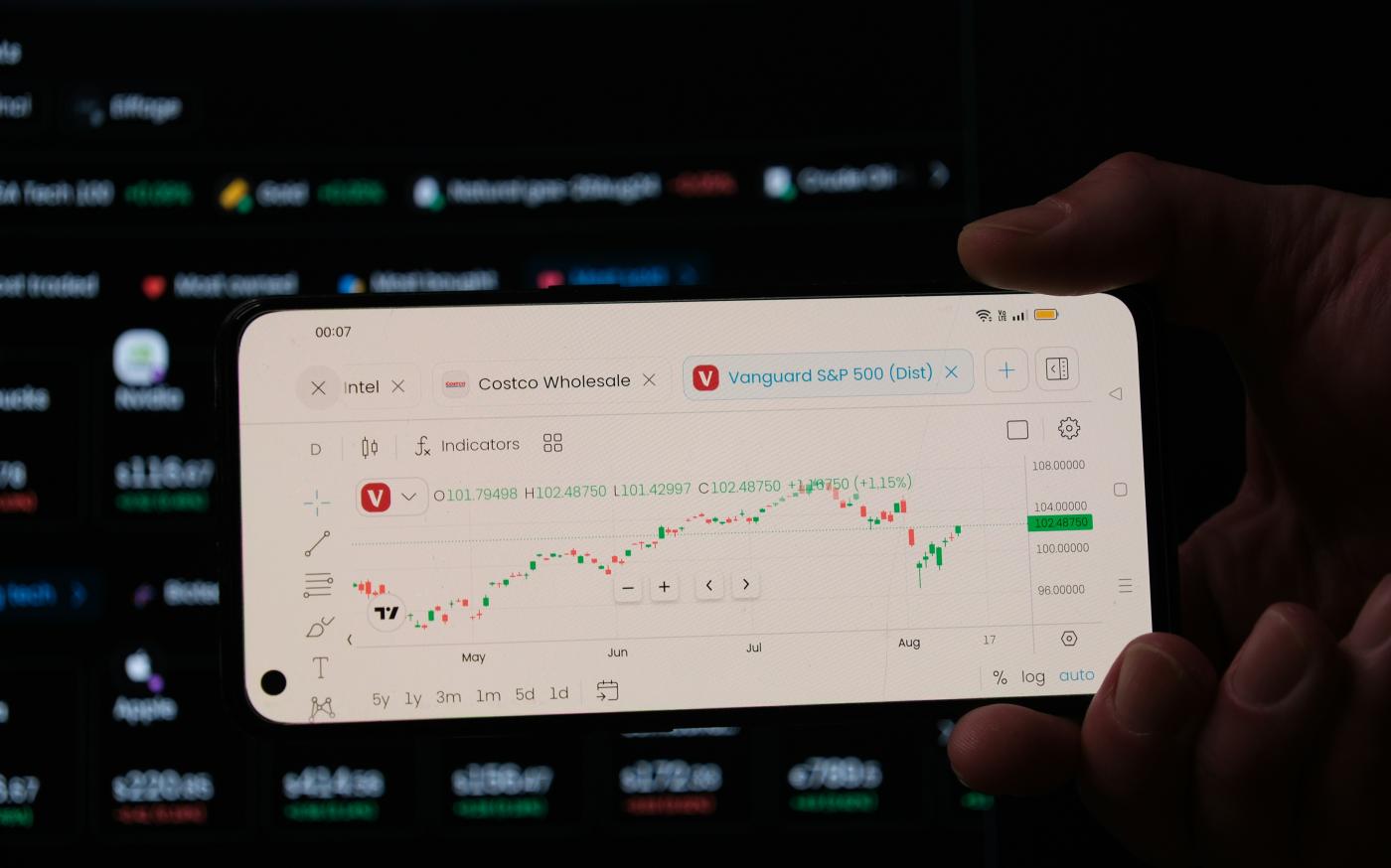

How Much Do You Know About Investing?

These days, investing in financial markets is a common practice. Yet, many Americans remain under-informed about how various investment products really work. Want to bridge this gap? Our wealth management services include a brief quiz, "Test Your Investment IQ," designed to enlighten you. Challenge yourself with our quiz and see where you stand. Whether you need investment management services or asset management services, understanding the basics can significantly contribute to your financial wellness.