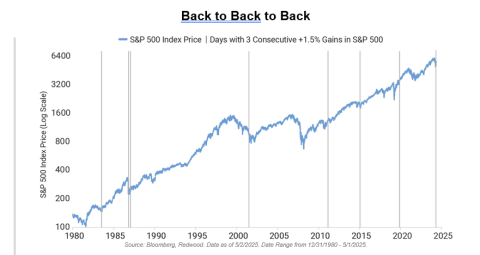

S&P 500 Rally: Encouraging Signal or Temporary Surge?

The S&P 500 has recently posted three consecutive days of gains greater than 1.5%, an uncommon pattern that historically has often preceded bull markets. While this type of strong, clustered performance can reflect improving sentiment, it's important to remember that markets can still be prone to sharp reversals even after encouraging signals. Past examples show that although momentum can build, volatility often remains elevated in the weeks that follow. Investors should stay mindful that short-term rallies, even powerful ones, do not always lead directly into sustained advances.

While we have seen this event occur recently, we will continue to implement our RiskFirst® process should this trend reverse, and markets display additional downside volatility to help you stay on track to meet your long-term goals.

Disclosure: This piece is for informational purposes only and contains opinions of Redwood that should not be construed as facts. Information provided herein from third parties is obtained from sources believed to be reliable, but no representation or warranty is made as to its accuracy or completeness. Charts and graphs are for illustrative purposes only. Discussion of any specific strategy is not intended as a guarantee of profit or loss. Past performance is not a guarantee of future results. The objectives mentioned are not guaranteed to be achieved. Investors cannot invest directly in any of the indices mentioned above. Diversification of asset class is not a guarantee against loss. RiskFirst® is a registered trademark of Redwood Investment Management, LLC.